The most important thing about money is the gap between your earnings and your spending. You must save or retain some money each month or you’ll never have any savings, which can fund investments or big purchases.

Fortunately, our margin in October was a healthy $1737. However, when you see how much we made, it sure seems like it could be much higher. You can increase your margin only by earning more or spending less. Of course, some of my spending below is actually saving but it’s saving for a specific item, so I’ve accounted it as spending.

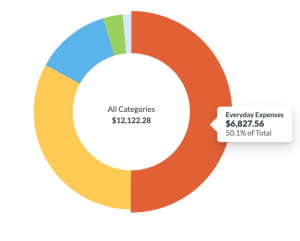

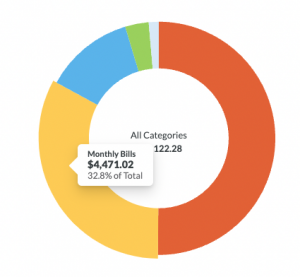

I use YNAB to track spending and it produces the nice reports above. Blue is giving, green is savings, and light gray is other.

Here is the breakdown of our October financial results.

GAP – $1737.00

Income – $13,845.48

- Total W2 income for the month.

- We also made $1,500 in rent and $14.06 in interest (not factored above). My goal is to avoid spending any rental income except for rental expenses. After several months, we’ll have sufficient funds to purchase another property with CASH!

- Fortunately, I’ve hit the Social Security maximum, so my paycheck is a bit higher for the remainder of the year. It’s almost a $1000/month raise, which is very nice.

Total Spending – $12,122

- School – $1840 – three kids in private school; not that bad considering, but I think this is a big deal and reduces our overall margin dramatically.

- Groceries/Household – $1730 – Insanely over our goal of $1250. A late-month Costco trip certainly did not help. Food costs are up, but we could certainly plan better here. We eat lots of meat and feed a family of 5. We budget all cleaning supplies and household items here. Remember, less categories is much better. This also includes almost $200 at freaking Ulta.

- Mortgage – $1627, plus $200 for insurance, and $300 for taxes, which are no longer escrowed, but I factor monthly.

- Giving – $1614.52

- Auto maintenance – $1,528

- One vehicle is several years old and requires some work. We had to fix a fuel pump for about $1100 and a crankshaft position sensor for about $475. We also washed our cash for $20, and that’s categorized as auto maintenance.

- Clothes – $771. I hate clothes shopping and generally hold out until the last minute. The problem is once I break the seal, I order lots of crap.

- Miscellaneous – $594. This is such a money suck. This includes several kid birthday presents, Halloween costumes, kids baseball fundraisers, a bathroom rug, mower oil, and just a bunch of crap that you either have to buy or you’re gonna have to fake it or get creative. We ain’t very creative.

- Restaurants – $531. We attended a few events that required lots of meals out. We also picked up the tab at a few of these events, which sometimes inflates the restaurant budget. Overall, given the nature of the events and our payment for others, we did not do that terribly here.

- Fuel – $351. Meh. Almost exactly on budget.

- Kids Activities – $437 – A kid had a birthday this month, plus the normal dance, baseball, and other crap.

- Entertainment – $404 -fundraisers, subscriptions, other crap for the birthday kid, Nintendo crap, concessions at ball games, parking at ball games, you name it.

- Medical – $235 – not bad; keep awaiting a large bill from a recent surgery

- TV/Internet – $182 – Netflix, Disney+, Hulu live, fiber internet

- Electricity – $182

- Water/Sewer – $67

- Car Insurance – $173

- country club – $125

- Cellphone – $90

- Haircuts – $55 – yes we spent $55 on haircuts. Insane.

Savings (factored into the above total spending amount)

- $225/College Savings

- $220/Fidelity Cash Account

Will need $13,000 in January to max out the Roth for 2023.